virginia estimated tax payments due dates 2021

For the 2022 tax year estimated tax payments are due quarterly on the following dates. 2021 payments claimed via your tax return can however be offset for any past due federal or state agency debt.

How To Record Paid Estimated Tax Payment

Insurers use actuarial science to determine the rates which involves statistical analysis of the various characteristics of drivers.

. 636b2 including-- A providing paid sick leave to employees unable to work due to the direct effect of the COVID-19. Payment Voucher for Individual Income Tax. Friday January 15th 2021.

Based on the Citadel Trojan which itself is based on the Zeus Trojan its payload displays a warning purportedly from a law enforcement agency claiming that the computer has been used for illegal activities such as downloading unlicensed software or child pornographyDue to this behaviour it is commonly. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live.

The automobile insurance market in the United States is a 308 billion US dollar market. This chapter shall be known as the Virginia Limited Liability Company Act. Individual Income Tax Filing Due Dates.

File Form 1040 or 1040-SR by April 18 2022. Pennsylvania Consumer Fireworks Tax Due Dates. The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000.

A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Estimated Tax Due Dates for Tax Year 2022. Thursday April 15th.

Utah adopts an 80 percent limitation as of tax year 2021. Due date of return. Returns are due the 15th day of the 4th month after the close of your fiscal year.

Reservation of power to amend or repeal. Download or print the 2021 Illinois Form IL-1040-ES Estimated Income Tax Payments for Individuals for FREE from the Illinois Department of Revenue. 2021 PA Realty Transfer Tax and New Home Construction Brochure.

Extension of temporary financing of short-time compensation payments in States with programs in law. For more information about the deferral of employment tax deposits go to IRSgovETD and see the Instructions for Form 941 available at IRSgovForm941. If you file your Form 1040 or 1040-SR by January 31 2022 and pay the rest of the tax that you owe with the form you dont need to make the payment due on January 18 2022.

For tax year 2021 Single residents must file if their gross income is more than 10000. 2022 Pennsylvania Wine Excise Tax Due Dates. The estimated tax payments are due on a quarterly basis.

Payroll credit for COVID-related paid sick leave or family leave. Child tax credit improvements for 2021. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000.

Individual Income Tax Return. Financial aid applicants about the opportunity to receive a financial aid adjustment due to the recent unemployment of a family member or. Each calendar year the state income tax due date may differ from the Regular Due Date because of a state.

And January 18 2022. No individual income tax. Real estate taxes are billed and payable in two installments.

Estimated Income Tax Payments for Individuals. We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference. The minimum penalty is 10 and the maximum penalty is 30 of the tax due.

Sample Real Estate Tax Bill If taxes are included in a property owners mortgage payments the City will bill the bank or mortgage company for taxes due. This extension does not apply to estimated payments due April 15 2021. Income Tax Deadlines And Due Dates.

Estimated tax payments must be made as the tax liability is incurred by April 15 2021. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. Due Dates for 2021 Estimated Quarterly Tax Payments.

308 B maintaining. Overview of IRS Fresh Start. Every state has a different minimum coverage requirement making auto insurance coverage more expensive in some states than others but they remain lower.

Virginia Limited Liability Company Act 131-1000. Internal Revenue Code Conformity for Tax Years 2018 2019 and 2020 as of March 29 2021. What will happen if I file Form VA-6H or pay the tax due after Jan.

These estimated payments are still due on April 15. PART 2--Child Tax Credit Sec. If you already got the third stimulus check as an advance payment in 2021 which would be reflected on IRS notice 1444-C or Letter 6475 mailed to you earlier this year you do not need to take any action.

2021 Tax Return. Your state will also have estimated tax payment rules that may differ from the federal rules. Typically most people must file their tax return by May 1.

Estimated Tax Voucher 2022 NJ Gross Income Tax Declaration of Estimated Tax form NJ-1040-ES Cut Along Dotted Line NJ Gross Income Tax Declaration of Estimated Tax NJ-1040-ES 2021 Calendar Year Due JANUARY 18 2022 Social Security Number required - 1 - OFFICIAL USE ONLY Voucher Check 4 if Paid Preparer Filed SpouseCU Partner Social Security. Texas June 15 franchise tax deadline Texas has extended the franchise tax deadline from May 15 to June 15 to provide relief to those affected by the severe winter storms. 2021 Tax Credit.

Late filing or late payment of the tax may result in the assessment of penalties and interest. New Jersey estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates. Common Tax Relief Forms.

Corporate and Individual Income Tax Conformity Dates of Static Conformity States. In 2012 a major ransomware Trojan known as Reveton began to spread. Any payments or deposits you made before December 31 2021 were first applied against your payment due on December 31 2021 and then applied against your payment due on December 31 2022.

In the table below you will find the income tax return due dates by state for the 2021 tax year. Guide to paying IRS quarterly estimated tax payments. Publication 3 - Introductory Material Whats New Reminders Introduction.

How much to pay when payments are due and the various payment options available to pay. 4 Use of funds--An advance provided under this subsection may be used to address any allowable purpose for a loan made under section 7b2 of the Small Business Act 15 USC. The second tax bill is mailed in October and is due by November 15.

The first tax bill is mailed in May and is due by June 15. 2021 Property Tax Rent Rebate Program Information. And those dates are roughly the same each year the 15th of April June September and the following January.

Under the Families First Coronavirus Response Act FFCRA as amended and the American Rescue Plan Act of 2021 the ARP an eligible employer can take a credit against payroll taxes owed for amounts paid for qualified sick leave or family leave if incurred during the allowed period which starts on April 1.

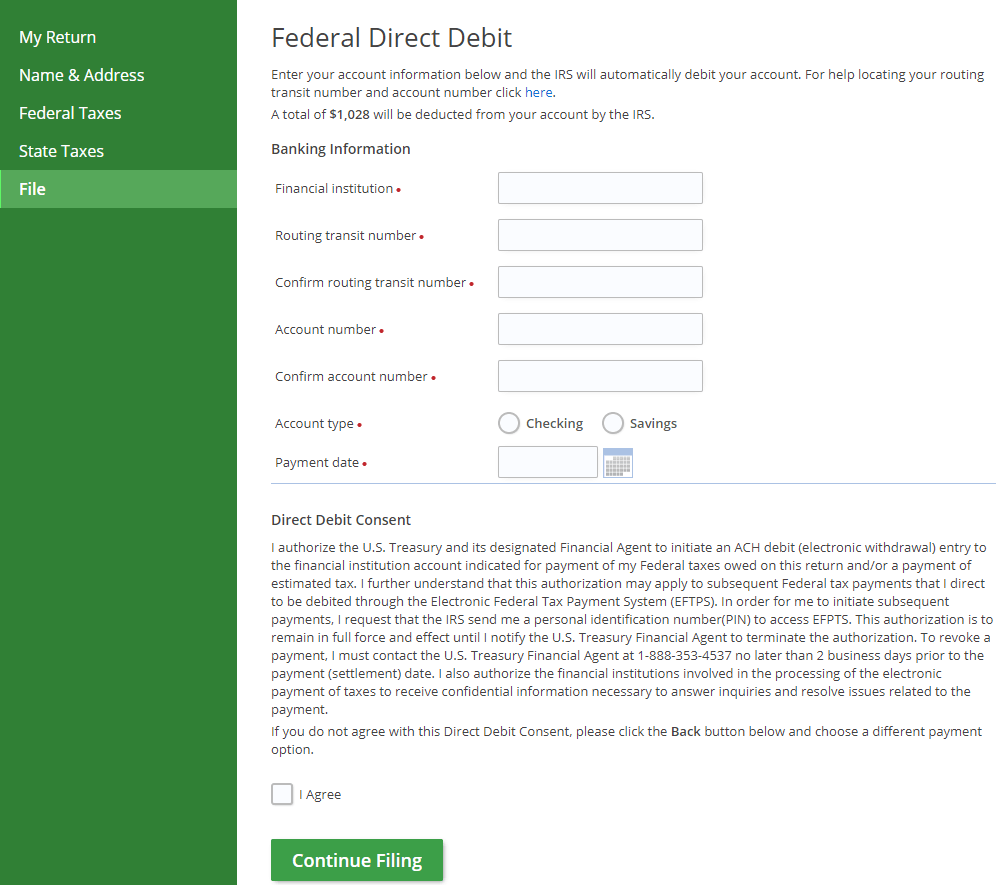

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

When Are Taxes Due In 2022 Forbes Advisor

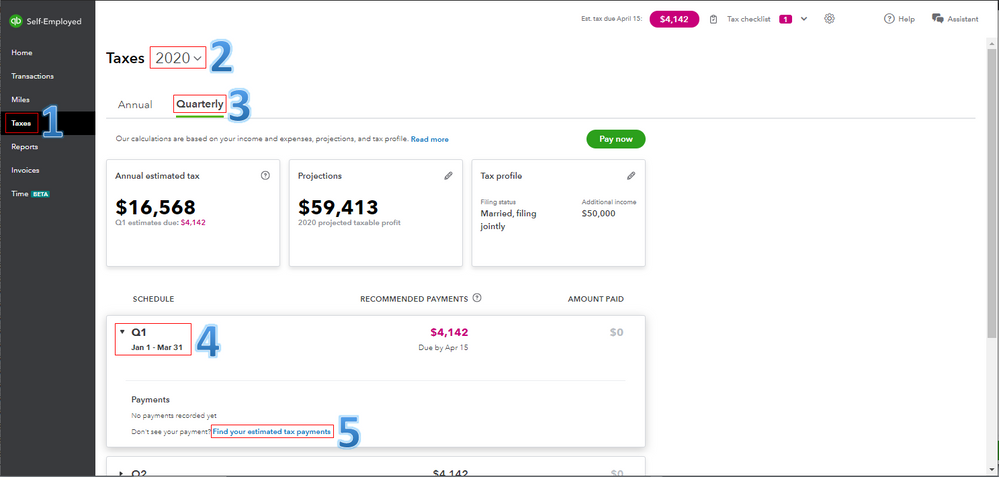

Estimated Tax Payments Due Dates Block Advisors

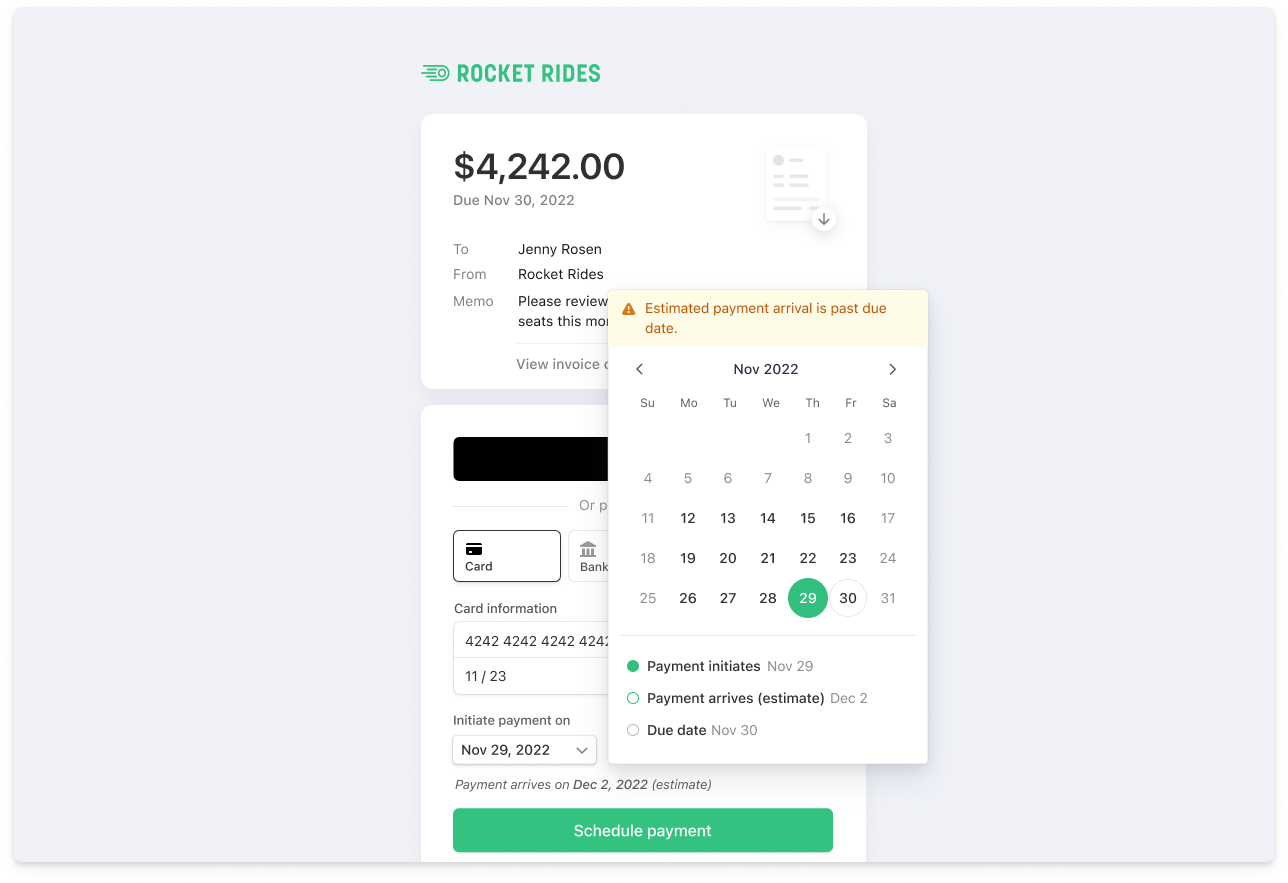

Scheduled Payments Stripe Documentation

Estimated Income Tax Payments For 2022 And 2023 Pay Online

The Main Reason People Refinance Their Home Loans In 2022 Home Loans Finance Understanding

The Complete Guide To Bookkeeping For Small Business Owners Small Business Finance Bookkeeping Business Small Business Bookkeeping

How To Record Paid Estimated Tax Payment

77 Inspiring Images Of Resume Examples For Freshers With No Work Experience Check More At Https Marketing Plan Template Event Planning Quotes Resume Examples

Cedar And Moss Terra Surface Artisan Ceramic Flush Mount Light Cedar And Moss Light Light Fixtures Flush Mount

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Scheduled Payments Stripe Documentation

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Real Estate Tips Buying First Home Real Estate Infographic

Cedar And Moss Terra Surface Artisan Ceramic Flush Mount Light Cedar And Moss Light Light Fixtures Flush Mount

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet